It is crucial to accomplish your exploration and go with a reputable custodian and gold IRA company to operate with. Try to look for companies which have a demonstrated background of achievement and fantastic customer opinions.

Cashing in on the gold IRA during retirement, ideally when you have a lessen earnings, means you’ll spend fewer in taxes. A Roth gold IRA performs by taxing your contributions, nevertheless withdrawals usually are not taxed.

Professional tip: A portfolio often will become more intricate when it's got much more investable property. You should solution this query that will help us connect you with the proper Qualified.

It's most important to notice you in no way buy gold or other precious metals with the IRA account resources personally. The IRS involves that your IRA account administrator do the particular transactions on your behalf.

We’ll uncover what the procedure involves And the way it might advantage you. Discover handy details to spice up your retirement financial savings, and call the specialists at Oxford Gold Team if you’d like To find out more about gold IRAs.

Take note: It is highly suggested that do your research and simply call a few unique companies before you make an investment decision conclusion. Also, talk to your economical advisor before buying any asset class.

This 3rd-social gathering company will help control your investments so that you can develop your portfolio. Compared with conventional brokers, a gold IRA custodian promotions exclusively with cherished metal investments.

Transfer among content trustees: It is possible to check with the establishment that retains your aged IRA to ship a distribution to another account and have no taxes withheld from your transfer account.

Your cherished metals will must be saved in an IRS-permitted depository. Most Gold IRA companies will handle the small print of the for yourself, like arranging protected transportation of the cherished metals into the depository.

The IRS has stringent regulations and regulations for Gold IRA accounts. The most crucial rule pertaining to self-directed IRAs like Gold IRAs, is by federal law it's essential to use an accredited IRA custodian to open this sort of retirement account.

Considered one of investors’ most important concerns When it comes to buying gold via a Gold IRA is how you can best fund that financial commitment.

The amount of should you just take from a traditional IRA or 401(k) and roll into a gold IRA? This problem stumps several buyers while working with a custodian over see it here the gold IRA rollover process.

Physical Ownership: You personal precious metallic bars, which make them far more difficult to confiscate or seize instead of Digital property.

This gold IRA rollover guide has important information that can assist you start out the procedure. If you want supplemental aid or want to debate this subject matter in greater depth with a gold IRA professional, the Oxford Gold Group is here to aid.

Tony Danza Then & Now!

Tony Danza Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Danica McKellar Then & Now!

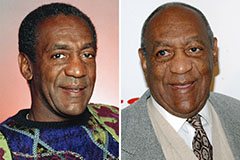

Danica McKellar Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!